Tax delinquency information is one of the most important public records for homeowners, buyers, and real estate investors. In Montgomery County, Ohio, the Treasurer and Auditor maintain detailed property tax data that allows the public to identify unpaid taxes, penalties, and delinquent balances. This guide explains how to perform a Montgomery County tax delinquency search, what the results mean, and how to resolve overdue taxes effectively.

What Is Tax Delinquency in Montgomery County?

A property becomes tax delinquent when the owner fails to pay real estate taxes by the county’s due dates. Once the payment becomes overdue, penalties and interest charges begin to accumulate. If the taxes remain unpaid for a longer period, the county may certify the delinquency to the state, and the property may later face foreclosure.

Tax delinquency affects:

- Property ownership and legal standing

- Refinancing and mortgage approvals

- Real estate sale transactions

- Eligibility for tax exemptions

- Possible county or state collection actions

Because of these impacts, checking tax delinquency status is essential for both homeowners and buyers.

Why Conduct a Tax Delinquency Search?

1. Verify Unpaid Taxes

A delinquency search helps confirm whether a property has outstanding taxes or penalties.

2. Avoid Hidden Debt

Anyone buying or investing in property must make sure that no overdue taxes will transfer with the sale.

3. Identify Foreclosure Risks

Multiple-year delinquencies may place a property at higher risk of tax foreclosure.

4. Check the Accuracy of Your Own Tax Records

Homeowners can ensure the county correctly applied their payments.

5. Evaluate Investment Opportunities

Delinquent taxes sometimes indicate properties that may enter future tax lien sales.

How to Search Tax Delinquency in Montgomery County

Below is the step-by-step process to accurately check tax delinquency information.

Step 1: Access the Montgomery County Property Search System

Begin by opening the county’s property information database. You can search using:

- Parcel Number (preferred)

- Property Address

- Owner Name

The Parcel ID ensures the most precise results.

Step 2: Open the Tax or Tax Summary Section

Once you locate the property, navigate to the tax section. This page typically displays:

- Annual tax charges

- Total unpaid taxes

- Penalties and interest

- Payment history

- Current balance due

- Special assessments

If the property is delinquent, the system will clearly show:

- Delinquent status

- Amount overdue

- Penalty charges

- Total payoff amount

Step 3: Review Delinquency Breakdown

The delinquency section often includes:

- Year-by-year unpaid taxes

- Monthly interest added

- Certification status

- Total delinquent balance

- Notices issued by the county

If a property is “certified delinquent,” unpaid taxes have been forwarded to the state for further action.

Step 4: Download or Print Delinquency Statements

Most Montgomery County tax pages offer downloadable:

- Payment history

- Tax bills

- Delinquent statements

- Official tax receipts

These documents are useful for transactions, legal matters, or personal record-keeping.

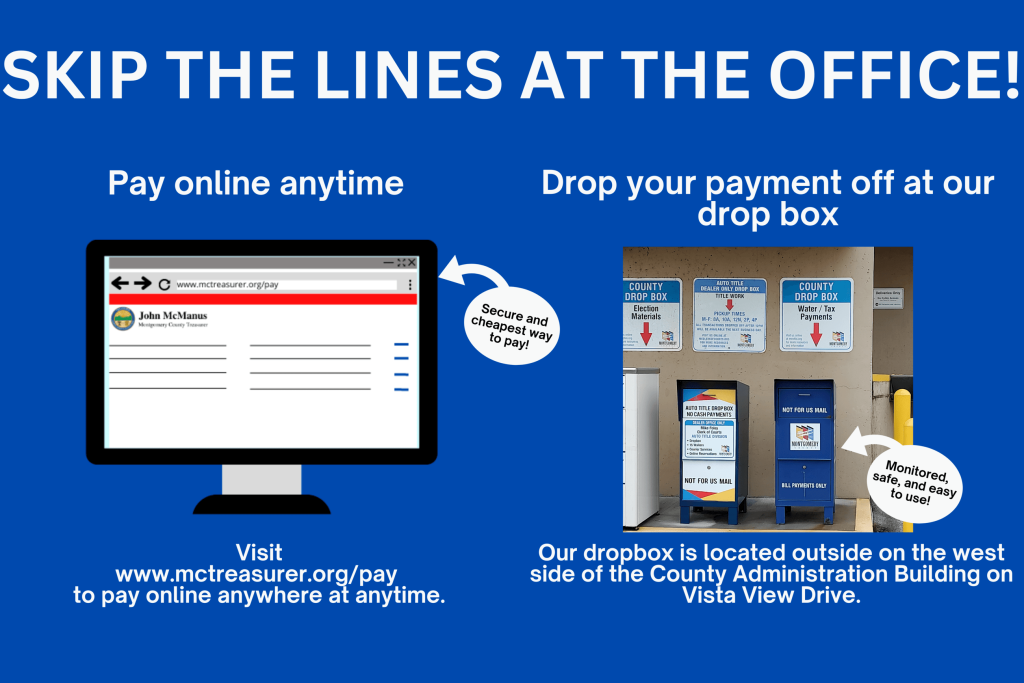

Step 5: Contact the Montgomery County Treasurer if Needed

If you believe your tax records are incorrect or you need clarification, you can contact the Treasurer’s Office to:

- Verify tax payments

- Request corrections

- Ask about available payment plans

- Confirm penalty calculations

- Resolve multi-year delinquencies

Homeowners facing difficulty may also qualify for financial relief or reduction programs.

Understanding Delinquency Status Results

When you search property tax information, you may see several types of results.

1. Current

All taxes are paid for the current tax year.

2. Delinquent

Unpaid taxes remain for the current or previous years.

3. Multi-Year Delinquency

Multiple tax years have outstanding balances, increasing risk of foreclosure.

4. Certified Delinquent

The county has transferred delinquent taxes to the state for collection.

5. Tax Lien Sold

If a lien is sold, a third party may have a financial claim against the property.

Understanding these statuses helps determine the urgency and legal position of the property.

How to Clear Delinquent Taxes in Montgomery County

If your own property appears delinquent, the following actions can help resolve the issue:

Pay the Full Balance

Paying the full delinquent amount immediately clears the status.

Request a Payment Plan

Some homeowners may arrange installment plans with the Treasurer’s Office.

Apply for Reduction Programs

Programs like the Homestead Exemption can reduce future tax bills.

Correct Errors

If you paid the taxes but they still appear unpaid, request a correction and submit proof.

Track Future Due Dates

Staying aware of future deadlines prevents additional penalties.

Tips for Buyers and Investors

- Always review multiple tax years to get the full financial picture.

- Check for unpaid assessments or liens separate from property taxes.

- Confirm whether the property has been certified delinquent.

- Investigate if the property is approaching foreclosure.

- Contact county offices if the record appears unclear or incomplete.

This extra research helps buyers avoid costly surprises during or after the purchase.

Conclusion

A tax delinquency search is a crucial part of property research in Montgomery County, Ohio. The county’s online system makes it easy to verify unpaid taxes, penalties, and certification status. Whether you are a homeowner checking your own records or a buyer evaluating potential investment risks, these searches provide essential financial and legal information.

Understanding delinquency details ensures better decision-making, helps avoid unexpected debts, and supports responsible ownership. Regularly monitoring tax status also protects property owners from penalties, interest, and potential legal action.

FAQs: Montgomery County Tax Delinquency Search

1. Are Montgomery County tax delinquency records public?

Yes, tax records are public information and can be accessed through the county’s property search system.

2. Can delinquent taxes stop me from selling my home?

Yes, unpaid taxes must usually be cleared before closing a real estate transaction.

3. Does Montgomery County allow tax payment plans?

Yes, in many cases the Treasurer offers installment arrangements for homeowners.

4. What information do I need to search delinquency status?

You can search using a parcel number, property address, or owner name.

5. How often are delinquency records updated?

The county regularly updates tax data to ensure accurate and current information.

- Ohio Property Tax Reform 2026: Impact on Montgomery County Homeowners

- How to Get Cigarette License in Montgomery County, Ohio

- How to Track Court Case Progress in Montgomery County OH

- How to Get a Property Record Copy from Montgomery County Auditor Ohio

- Montgomery County Jail Release & Bond Information Search