Senior citizens living on fixed or limited income often struggle to manage rising property tax costs. To support older residents, Montgomery County offers several tax reduction programs that help lower annual property tax bills and make homeownership more affordable. These benefits are designed to protect seniors from financial stress and allow them to remain in their homes comfortably as they age.

Below, you will find a clear guide to how these reduction programs work, who qualifies, and the benefits seniors can receive.

What Are Senior Tax Reduction Programs?

Senior tax reduction programs are government-supported benefits that reduce the taxable value of a home, lower property tax rates, or provide direct credits on tax bills. These programs are especially helpful for retired residents who rely on pensions, Social Security, or savings for monthly income.

Why Montgomery County Offers These Programs

Montgomery County aims to support aging populations by:

- Reducing yearly property tax pressure

- Helping seniors stay in their homes longer

- Offering relief to low-income and retired households

- Encouraging financial independence and stability

These programs benefit thousands of homeowners each year.

Main Senior Tax Relief Programs Available

Easy to understand:

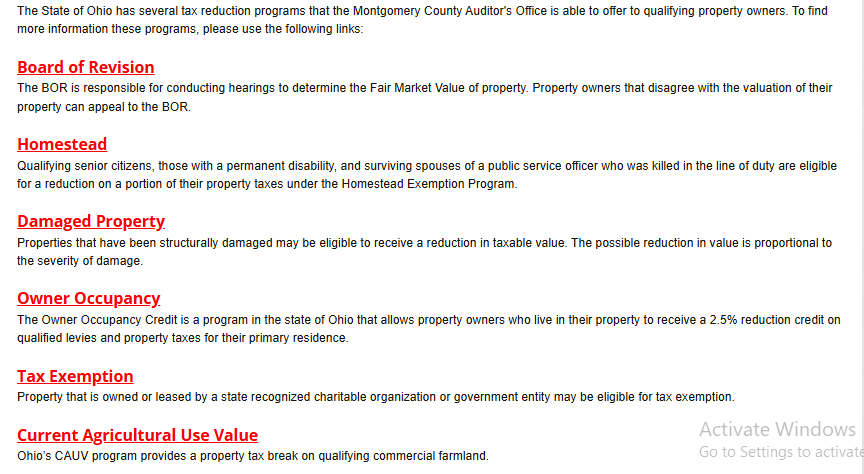

1. Senior Homestead Exemption

The homestead exemption reduces the taxable value of a primary home. Seniors who qualify can pay significantly lower taxes each year.

Typical requirements include:

- Age 65 or older

- Owner must live in the home

- Only applies to primary residence

This exemption helps reduce tax bills for long-term homeowners who want to stay in their communities.

2. Income Based Tax Reduction

Some seniors qualify for additional tax savings based on income level. Tax bills may be lowered or capped to keep yearly payments affordable.

These programs especially help:

- Low-income seniors

- Widowed or single homeowners

- Retired seniors living on fixed income

3. Disabled Senior Tax Credits

Seniors with permanent disabilities may receive extra tax reductions. Proof of disability or medical documentation is typically required.

4. Veteran Senior Tax Relief

Senior military veterans may be eligible for special tax credits. These benefits often apply to disabled veterans, surviving spouses, or those with service-connected conditions.

5. Property Tax Freeze Programs

Some counties offer a tax freeze option that stops property tax bills from increasing even if home value rises. Seniors can lock in their tax rate and avoid future increases.

General Eligibility Requirements

While details vary by county or state, most Montgomery County senior benefits require:

- Age 65+

- Primary home ownership

- Full-time residency in the county

- Basic income verification

- No major property liens owed

Seniors should apply early because most programs follow yearly deadlines.

Documents Usually Needed

- Government ID

- Proof of ownership

- Tax return or income statement

- Residency documents

- Application forms

Keeping these ready makes approval faster and easier.

Benefits of Senior Tax Savings in Montgomery County

Senior tax relief provides long-term financial support, including:

- Lower annual tax bills

- Home budget stability

- Reduced financial stress

- Ability to remain in the same home

- Protection from sudden tax increases

This relief is essential for seniors who depend on fixed monthly income.

Tips Before Applying

- Review income guidelines carefully

- Recheck residency rules

- Ask about payment plans

- Explore veteran or disability add-ons

- Apply early to avoid delays

Conclusion

Senior citizen tax reduction programs in Montgomery County offer valuable support to older homeowners. Through homestead exemptions, income-based credits, veteran benefits, and property tax freezes, seniors can significantly lower their yearly tax payments. These programs make aging in place possible and reduce financial worry for thousands of residents.

For seniors living on retirement income, these tax reductions are more than savings—they are long-term tools for stability, independence, and peace of mind.

FAQs

1. What tax reduction programs are available for seniors in Montgomery County?

Montgomery County offers tax relief programs such as the Homestead Exemption, which reduces the taxable value of a senior’s primary residence and lowers annual property taxes.

2. Who qualifies as a senior citizen for tax reductions in Montgomery County?

Homeowners who are 65 years or older, own and occupy their home as a primary residence, and meet Ohio residency requirements may qualify for senior property tax reductions.

3. Is there an income limit for senior tax reduction programs?

Yes, most senior tax relief programs in Montgomery County have annual household income limits set by the State of Ohio. These limits may change each year.

4. How much can seniors save on property taxes?

Savings vary by tax district and property value, but eligible seniors can save hundreds of dollars annually through reduced assessed value and lower tax bills.

5. How do seniors apply for property tax reduction programs?

Applications can be submitted through the Montgomery County Auditor’s Office by mail or in person. Required documents may include proof of age, income, and residency.

6. When should seniors apply for tax reduction benefits?

Seniors should apply as soon as they become eligible, ideally early in the year, to ensure benefits are applied before property tax bills are issued.

7. Does the tax reduction continue every year?

Yes, once approved, most senior tax reduction programs automatically renew each year unless ownership, residency, or income status changes.

8. Can senior citizens appeal their property tax assessment?

Yes, seniors may appeal property tax assessments through the Montgomery County Board of Revision if they believe their property value is incorrect.

9. Do tax reduction programs apply to rental or second homes?

No, senior tax reduction programs apply only to owner-occupied primary residences in Montgomery County.

10. Where can seniors get help or more information?

Seniors can contact the Montgomery County Auditor’s Office or visit official county resources for up-to-date information on eligibility, applications, and deadlines.